Global Aspirations.

Indian Values.

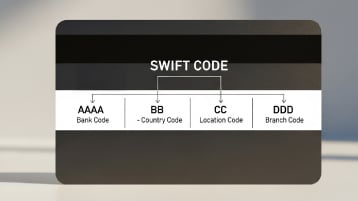

Stay connected to your roots with banking services, remittances and investment solutions that bring India to you.